Amy Chats Cross border: As an Amazon European website, the cost of registering for Czech VAT has actually decreased?

You can obtain our exclusive organized knowledge dry goods

?

As is well known, the current threshold for Amazon's European website is relatively high, mainly due to increasingly strict compliance requirements for European websites. The cost of establishing a European station is not low due to compliance fees such as VAT registration and EPR registration in multiple countries, as well as logistics fees for local and cross-border distribution. But why do sellers reduce costs after registering for Czech VAT? It is actually because one of the European logistics solutions provided by Amazon to sellers - the Central Europe Plan.

Firstly, under what circumstances do cross-border e-commerce sellers need to register for Czech VAT? Generally speaking, sellers face three different scenarios:

1. We have launched the Amazon Pan European Program or the Central European Program. Because you are using Amazon's FBA warehouse, the warehouse is automatically allocated by Amazon;

2. The seller uses a local warehouse in the Czech Republic, whether it is a third-party overseas warehouse or a self built warehouse. As long as there is a warehouse in the Czech Republic, it is necessary to register the Czech VAT number;

3. There are sellers selling in Czech Republic, but there are no warehouses in Czech Republic. Registration in this case is voluntary.

In summary, as long as you use a Czech warehouse, you must register for Czech VAT.

Registering Czech VAT can reduce logistics costs!

From the long-term development of the store, registering Czech VAT can use the China Europe Plan; In other words, if the seller wants to use the Amazon Central Europe program, they must register for Czech VAT.

China Europe Plan

China Europe Plan

Fulfillment Network Expansion, also known as distribution network expansion, allows sellers to use Amazon's logistics centers in Poland and the Czech Republic to store inventory.

For sellers on Amazon's European website, they often encounter situations where the quantity of goods is large and the warehouse is not sufficient. At this time, many people will use the China Europe plan,

Sellers can then store their inventory in Amazon operations centers located in Poland and the Czech Republic.

If not included in the plan, inventory needs to be stored in the German operations center.

After joining the plan, Amazon will require sellers to transport Amazon logistics inventory to an address located in Germany. Afterwards,

Amazon will make its own decision

How to allocate inventory between Amazon logistics operation centers in Germany, Poland, and the Czech Republic.

There is no additional fee required to use this service.

Joining the China Europe Plan has two main benefits:

Your buyer will receive orders quickly and have a great shopping experience.

Because Czech Republic is a hub of multiple EU countries. If the goods are stored in the Czech Republic and then transported to various EU countries, it can greatly save shipping time and enable faster delivery to buyers.

Joining Amazon's China Europe program can save on logistics and delivery costs

Sellers who have not joined the China Europe plan can only store their inventory in the German operation center and ship from the German FBA. Goods shipped to other EU countries

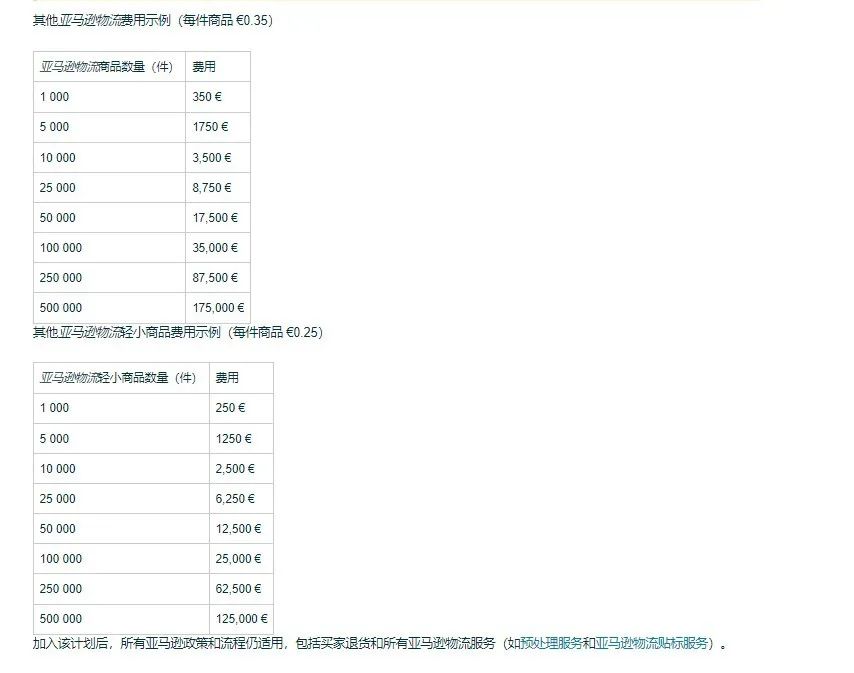

An additional delivery fee of 0.35 euros per item is required

The additional shipping cost for small and light items is per item

0.25 euros

After joining the China Europe Program, Amazon will no longer charge these additional logistics and delivery fees. That is to say, shipping your goods from Czech and Polish warehouses can save you 0.35 euros in shipping costs per item.

book

The more sellers have a single quantity, the more logistics costs they can save.

The following is the quantity of Amazon logistics products and some details of the cost savings we have saved you after joining the China Europe program. Sellers can scan the QR code at the end of the article and add Shazhixing cross-border customer service to inquire about the Czech VAT registration price before comparing it. What is the most cost-effective solution.

(Image sourced from Amazon backend)

So, joining Amazon's China Europe plan can reduce logistics delivery costs. Although joining Amazon's Central Europe program is completely free, because your inventory must be transferred in Poland and Czech Republic, you must register for VAT numbers in these two countries.

How to launch the China Europe Plan?

1. Click on "Settings" on the seller platform, and then select "Amazon Logistics".

2. Click on "Edit" in the "Cross border Logistics Settings" column.

3. Click on "Enable inventory warehousing" and click on the checkbox in Germany

After clicking on the checkbox in Germany, there are two options. Click to select "Store in Germany, Poland, and Czech Republic".

(Image sourced from Amazon backend)

5. Click on 'Update' to save the changes.

By doing so, you can activate the China Europe Plan.

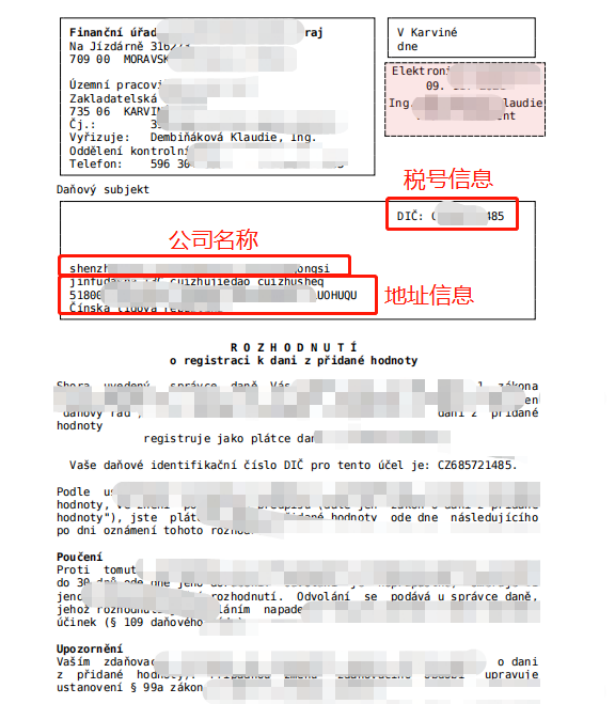

Czech VAT registration information

1. Tax rate: 21%

2. Tax representative:

There is no mandatory requirement, but the tax bureau suggests that overseas companies should appoint a tax representative to be responsible for tax matters

3. Czech VAT registration information:

To apply for Czech VAT, the following information is required

(Scan copy without watermark, high-definition version, guaranteed to be complete, and all documents have not expired):

A. PoA stamped, signed and returned.

B. Corporate ID card (translated in English or Czech)/Corporate passport (no translation required)

C. Business License: (Translated into English or Czech)

D. Tax ID documents of other EU countries

E. Bank account certificate: The certificate is owned by its company

F. Store backend link (if not provided with expected sales date and monthly expected sales date)

G. Czech VAT Registration Application Form

4. Application deadline: 4-6 weeks

5. VAT ID Certificate

6. VAT declaration method: monthly/quarterly declaration, no annual report

7. Number of VAT declarations:

Quarterly declaration: Four declarations are made annually (i.e. four quarterly declarations), with quarterly declarations made in April, July, October, and January of the following year.

Monthly declaration: 12 declarations per year

Relevant Penalty Rules for Czech Taxes

01

Penalty rules for taxes

If the Czech value-added tax declaration form is misreported or resubmitted, foreign companies may be punished.

Late submission or non registration of VAT will result in a penalty calculated on the basis of possible loss of income, with a maximum penalty of 300000 Czech koruna.

Underreporting, misreporting, or failure to declare will result in a penalty of 20% of the additional tax burden.

In addition, overdue payment interest for value-added tax should be charged at the repurchase rate set by the Czech National Bank plus 14%. Interest can only be charged for five years.

02

Value added tax refund rules

Companies with Czech value-added tax numbers must submit regular payments.

Usually, filing and payment are submitted monthly in the Czech Republic. Any Czech tax credit should be paid within 30 days, but usually requires a longer period of time.

In addition to the Czech Republic's value-added tax declaration form, companies may also need to submit additional statistical information.

The Czech Republic lists sales (shipments) and procurement (acquisitions) within the EU region, which must be submitted monthly after exceeding the annual threshold.